What is a Demand Draft (DD) SBI DD Making Charges Demand Draft Details Demand Draft Fee Calculation Demand Draft Charges ICICI Bank DD Making Charges? Central Bank Bank DD Making Charges HDFC Bank DD Making Charges.

In the current day, both interest drafts and check are losing their significance as asset move instruments. The justification for this is that the people today favor making a large portion of their installments via IMPS, NEFT or RTGS. Nonetheless, even today there are sure applications for assessments, administrations, occupations, acquisition of a higher sum, affirmations, and so forth, which require the client to make installment via request drafts.

Check are not liked by them as it has a chance of being disrespected if there should arise an occurrence of deficient equilibrium in the ledger instead of interest draft that can never be shamed. Here, we’ll talk about request draft subtleties, highlights of an interest draft and the charges to make an interest draft. How about we investigate request draft subtleties individually.

What is DD Demand Draft?

which is paid ahead of time. In this installment component, the payer bank certifications to make the full installment when the interest draft is introduced by the payee.

- Demand draft is payable just at a predefined focus of a predetermined part of the bank

- Normally, a check isn’t acknowledged in a great deal of exchanges in light of the fact that the payee and drawee are obscure. Also, there is acknowledge hazard as the check would ricochet

- In such a case, Demand Draft is acknowledged as the exchange of cash is ensured here

- The time of legitimacy for an Demand Draft is 3 months

Demand Draft Details

Demand drafts is a payment mechanism which is payable on demand

You cannot pay a demand draft to a bearer

To be able to obtain the payment of the demand draft, the beneficiary will have to either present the DD to the concerned branch or will have to get it collected from his or her bank by way of the clearing mechanism

Further Demand Draft details can be seen in Section 85(A) of the Negotiable Instrument Act, 1881

Demand Draft Fee Calculation

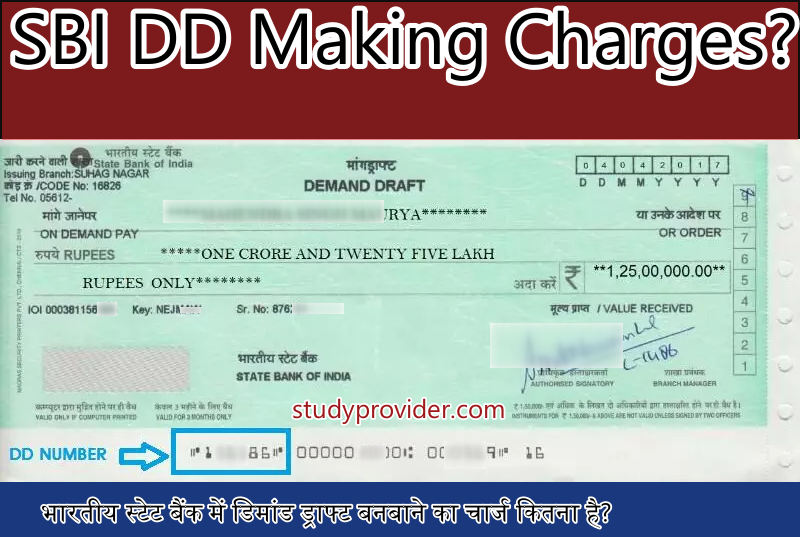

Every bank has its own rates for making a demand draft. For instance, the Demand Draft issuing charges for SBI is:

For DD value of Rs. 10,000 to Rs. 1,00,000 – Rs. 5 per Rs. 1,000 or a part thereof.

So, how will you calculate the demand draft charges by the State Bank of India? Let’s find out.

To calculate the demand draft charges per Rs. 1,000,

- 5/1000= 0.005

- Now, you’ll have to use this figure to multiply with the amount.

- For example, if the Demand draft is of the amount RS. 12,000, the Demand Draft charges will be 12,000 * 0.005 = Rs. 60

- Similarly, if the Demand Draft is of the amount Rs. 22,500, the Demand Draft charges will be 22,500 * 0.005 = Rs. 112.5.

Please note that in case of a salary account, you might not have to bear any demand draft making charges up to a given amount. For instance, if you have a salary account in HDFC bank, you can make demand drafts up to a sum of 1 Lakh per day for free.

Demand Draft Charges

Let’s take a look at demand draft charges of ICICI Bank and SBI Bank Service Charge List.

For Issue of Demand Draft

SBI Bank

- For an amount up to Rs. 5,000- Rs. 25 inclusive of the GST.

- For an amount above Rs. 5,000 and up to Rs. 10,000- Rs. 50 inclusive of the GST.

- For an amount above Rs. 10,000 and up to Rs. 1,00,000- Rs. 5 inclusive of the Service Tax per Rs. 1,000 or part thereof. Minimum DD charges in this case will be Rs. 60 inclusive of GST.

- For an amount above Rs. 1,00,000- Rs. 4 inclusive of the Service Tax per Rs. 1,000 or part thereof.

- Minimum DD charges in this case will be Rs. 600 inclusive of GST. Maximum DD charges in this case will be RS. 2,000 inclusive of GST.

ICICI Bank

- For an amount up to Rs. 10,000- Rs. 50 inclusive of the GST.

- For an amount above Rs. 10,000 — Rs. 3 inclusive of the GST per Rs. 1,000 or part thereof. Minimum DD charges, in this case, will be Rs. 75 inclusive of GST. Maximum DD charges, in this case, will be Rs. 15,000 inclusive of GST.

- If you wish to know about the service charges of the different banks in detail, you can either visit the RBI website or go to the respective bank’s website.

Demand Draft charges of some of the popular Banks in India

| Name of the Bank | Demand Draft Charges |

| State Bank of India* |

|

| HDFC (Through bank) |

|

| HDFC (Through net banking) |

|

| ICICI Bank |

|

| Axis Bank |

|

| HSBC | From HSBC Bank –

|

| Bank of Baroda |

|

| Punjab National Bank | Non-Individuals (General public) –

|

*SBI DD charges are as on 01 April 2018.

**Applicable at bank branches in India. DD is free if you use HSBC internet banking. 25% of Rs.100 if you do it through HSBC phone banking.

***Location does not matter for senior citizens and pensioners.

**** Nil for students who have availed an education loan from PNB.

DD charges for some of the popular banks are mentioned here. If you are looking for a particular bank, visit the bank’s official website.

| Find Bank Details Using IFSC Code | Get Full Address of Any Bank Using IFSC Code |

| Know About Your Bank Branch | How to Contact Bank for DD Making |

FAQs of Demand Draft Charges

Can demand draft be made online?

Ans: Yes, a demand draft can be made online.

Do all banks charge the same amount for making a demand draft?

Ans: No, the amount charged for making a demand draft varies from bank to bank.

If I cancel the demand draft, will I be charged?

Ans: Yes, you will be charged a minimum amount if you cancel the demand draft.

Will the person be paid once he/she submits the demand draft in the bank even though there are insufficient funds in the bank account?

Ans: Yes, he/she will be paid as the drawer would have already paid the amount when making the demand draft. It needs to be mentioned here that the demand draft is a prepaid payment instrument.

Does SBI charge the same amount for making a demand draft, irrespective of the money?

Ans: No, SBI doesn’t charge the same amount. The amount charged varies depending on the amount for which the demand draft is being made by the drawer.